This process included:

a review of our compensation programs and practices, including our historical compensation practices;

analysis of programs or program features and practices that could potentially encourage excessive or unreasonable risk-taking of a material nature;

a review of business risks that these program features could potentially encourage;

identification of factors that mitigate risks to the business and incentives for executives to take excessive risk, including, among others, a review of compensation design and elements of the compensation programs; the balance among these program elements; role of compensation consultants and other

10

| | |

| | • | a review of our compensation programs and practices, including our historical compensation practices; |

|

| • | analysis of programs or program features and practices that could potentially encourage excessive or unreasonable risk-taking of a material nature; |

|

| • | a review of business risks that these program features could potentially encourage; |

|

| • | identification of factors that mitigate risks to the business and incentives for executives to take excessive risk, including, among others, a review of compensation design and elements of the compensation programs, role of compensation consultants and other advisors,advisors; authority and discretion of the Board, the ECC and other Board committees in compensation,compensation; controls and procedures,procedures; program and cultural elements and potential for individual or group influences; and |

consideration of the balance of potential risks and rewards related to our compensation programs and its role in implementation of our corporate strategy.

Codes of Conduct and Ethics and Other Policies

Global Code of Conduct for Associates. We have a Global Code of Conduct for our Associates that requires our Associates to conduct our business with integrity. Our Global Code of Conduct covers professional conduct, including employment policies, ethical business dealings, conflicts of interest, confidentiality, intellectual property rights and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. We have a Code of Conduct helpline to allow Associates to voice their concerns. We also have procedures for Associates to report complaints regarding accounting and auditing matters. Information about the helpline and reporting procedures are available on our website, www.tjx.com.

Code of Ethics for TJX Executives and Director Code of Business Conduct and Ethics. We have a Code of Ethics for TJX Executives governing our Chairman, Chief Executive Officer, President, Chief Financial Officer and other senior operating, financial and legal executives. The Code of Ethics for TJX Executives is designed to ensure integrity in our financial reports and public disclosures. We also have a Director Code of Business Conduct and Ethics that promotes honest and ethical conduct, compliance with applicable laws, rules and regulations and the avoidance of conflicts of interest. We intend to disclose any future amendments to, or waivers from, the Code of Ethics for TJX Executives or the Director Code of Business Conduct and Ethics within four business days of the waiver or amendment through a website posting or by filing a Current Report on Form 8-K with the Securities and Exchange Commission, or SEC.

Stock Ownership Guidelines for Directors and Executives. Our Corporate Governance Principles provide that a director is expected to acquire initially at least $10,000 of our common stock outright and to attain stock ownership with a fair market value equal to at least five times the annual retainer paid to the directors within five years of initial election to the Board. As described further in the Compensation Discussion and Analysis section, our Chief Executive Officer is expected to attain stock ownership with a fair market value equal to at least five times annual base compensation and our President, our Chief Financial Officer and each Senior Executive Vice President is expected to attain stock ownership with a fair market value of at least three times annual base compensation. At age 62, such ownership guidelines are reduced by fifty percent.

Board Annual Performance Reviews. We have a comprehensive review process for evaluating the performance of our Board and our directors. Our Corporate Governance Committee oversees the annual performance evaluation of the entire Board, our Chairman, our Lead Director, each of our committees and its chair, and each of our individual directors.

Environmental Sustainability. As part of our continued commitment to corporate responsibility, TJX has long pursued initiatives that are good for the environment as well as our profitability. We believe in the value of environmentally sound business practices throughout our operations, including energy and water conservation as well as recycling and waste reduction efforts. We have discussed our programs with stockholder groups over the years and understand the importance of strong, sustainable business practices to our business, stockholders, Associates, customers and communities. Our corporate social responsibility report, which highlights efforts we have made in these initiatives, is available on our website, www.tjx.com, in the Corporate Responsibility section.

Online Availability of Information. The current versions of our Corporate Governance Principles, Global Code of Conduct, Code of Ethics for TJX Executives, Director Code of Business Conduct and Ethics, and

11

charters for our Audit, Corporate Governance, Executive, Executive Compensation and Finance Committees are available on our website, www.tjx.com in the Corporate Responsibility: Attention to Governance section. Information appearing on www.tjx.com is not a part of, and is not incorporated by reference in, this Proxy Statement.

Communications with the Board

Security holders and other interested parties may communicate directly with the Board, the non-management directors or the independent directors as a group, specified individual directors or the Lead Director by writing to such individual or group c/o Office of the Secretary, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701. The Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board. Stockholders and others can communicate complaints regarding accounting, internal accounting controls or auditing matters by writing to the Audit Committee, c/o Corporate Internal Audit Director, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701.

Transactions with Related Persons

Under the Corporate Governance Committee’s charter, the Committee is responsible for reviewing and approving or ratifying any transaction in which TJX is a participant and any of our directors, director nominees, executive officers, 5% stockholders and their immediate family members is a participant and has a direct or indirect material interest as provided under SEC rules. In the course of reviewing potential related person transactions, the Corporate Governance Committee considers the nature of the related person’s interest in the transaction; the presence of standard prices, rates or charges or terms otherwise consistent with arms-length dealings with unrelated third parties; the materiality of the transaction to each party; the reasons for TJX entering into the transaction with the related person; the potential effect of the transaction on the status of a director as an independent, outside or disinterested director or committee member; and any other factors the Committee may deem relevant. Our General Counsel’s office is primarily responsible for the implementation of processes and procedures for screening potential transactions and providing information to the Corporate Governance Committee. During fiscal 2014, Charles Bairos, brother-in-law of Ms. Meyrowitz, our CEO, and Barbara House, sister-in-law of Mr. Sherr, an executive officer, were employed by TJX. They received compensation from us, consistent with other Associates at their respective levels and responsibilities, totaling approximately $172,145 and $131,384, respectively, for fiscal 2014, including salary and incentive compensation. They each also participated in company benefit plans generally available to similarly situated Associates. Lisa Cammarata, daughter of Mr. Cammarata, our Chairman, is an executive and an owner of one of the vendors from which TJX acquires merchandise from time to time. Since the beginning of fiscal 2014, TJX purchased approximately $5.6 million in merchandise from that vendor. Our Corporate Governance Committee discussed and approved these transactions, consistent with our review process described above.

Audit Committee Report

The Audit Committee operates in accordance with a written charter adopted by the Board and reviewed annually by the Committee. We are responsible for overseeing the quality and integrity of TJX’s accounting, auditing and financial reporting practices. The Audit Committee is composed solely of members who are independent, as defined by the NYSE and TJX’s Corporate Governance Principles. Further, the Board has determined that two of our members (Mr. Hines and Ms. Lane) are audit committee financial experts as defined by the rules of the SEC.

We met 10 times during fiscal 2014, including four meetings held with TJX’s Chief Financial Officer, Corporate Controller, Corporate Internal Audit and PricewaterhouseCoopers LLP, or PwC, TJX’s independent registered public accounting firm, prior to the public release of TJX’s quarterly and annual earnings announcements in order to discuss the financial information contained in the announcements. Management has

12

the responsibility for the preparation of TJX’s financial statements, and PwC has the responsibility for the audit of those statements.

We took numerous actions to discharge our oversight responsibility with respect to the audit process. We reviewed and discussed the audited financial statements of TJX as of and for fiscal 2014 with management and PwC. We received the written disclosures and the letter from PwC required by applicable requirements of the Public Company Accounting Oversight Board (PCAOB) regarding the independent accountant’s communications with the audit committee concerning independence and the potential effects of any disclosed relationships on PwC’s independence and discussed with PwC its independence. We discussed with management, the internal auditors and PwC, TJX’s internal control over financial reporting and management’s assessment of the effectiveness of internal control over financial reporting and the internal audit function’s organization, responsibilities, budget and staffing. We reviewed with both PwC and our internal auditors their audit plans, audit scope and identification of audit risks.

We reviewed and discussed with PwC communications required by the Standards of the PCAOB (United States), as described in PCAOB Auditing Standard 16, “Communication with Audit Committees,” and, with and without management present, discussed and reviewed the results of PwC’s examination of TJX’s financial statements. We also discussed the results of the internal audit examinations with and without management present.

Based on these reviews and discussions with management and PwC, we recommended to the Board that TJX’s audited financial statements be included in its Annual Report on Form 10-K for fiscal 2014 for filing with the SEC. We also have selected PwC as the independent registered public accounting firm for fiscal 2015, subject to ratification by TJX’s stockholders.

Audit Committee

Michael F. Hines,Chair

José B. Alvarez

David T. Ching

Amy B. Lane

Auditor Fees

The aggregate fees that TJX paid for professional services rendered by PwC for fiscal 2014 and fiscal 2013 were:

| | | | | | | | |

In thousands | | 2014 | | | 2013 | |

Audit | | $ | 5,482 | | | $ | 5,106 | |

Audit Related | | | 403 | | | | 398 | |

Tax | | | 495 | | | | 258 | |

All Other | | | 227 | | | | 197 | |

| | | | | | | | |

Total | | $ | 6,607 | | | $ | 5,959 | |

Audit fees were for professional services rendered for the audits of TJX’s consolidated financial statements including financial statement schedules and statutory and subsidiary audits, assistance with review of documents filed with the SEC, and opinions on the effectiveness of internal control over financial reporting with respect to fiscal 2014 and fiscal 2013.

Audit related fees were for services related to consultations concerning financial accounting and reporting standards and employee benefit plan and medical claims audits.

13

Tax fees were for services related to tax compliance, planning and advice, including assistance with tax audits and appeals, tax services for employee benefit plans, and requests for rulings and technical advice from tax authorities.

All other fees were for services related to training for TJX’s internal audit department and advisory services in our on-going development of TJX’s conflict minerals program in compliance with Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act in fiscal 2014 and training for TJX’s internal audit department and services related to TJX’s acquisition of Sierra Trading Post in fiscal 2013.

The Audit Committee of the Board pre-approves all audit services and all permitted non-audit services by PwC, including engagement fees and terms. The Audit Committee has delegated the authority to take such action between meetings to the Audit Committee chair, who reports the decisions made to the full Audit Committee at its next scheduled meeting.

Our policies prohibit TJX from engaging PwC to provide any services relating to bookkeeping or other services related to accounting records or financial statements, financial information system design and implementation, appraisal or valuation services, fairness opinions or contribution-in-kind reports, actuarial services, internal audit outsourcing, any management function, legal services or expert services not related to the audit, broker-dealer, investment adviser, or investment banking services or human resource consulting. In addition, the Audit Committee evaluates whether TJX’s use of PwC for permitted non-audit services is compatible with maintaining PwC’s independence. The Audit Committee concluded that PwC’s provision of non-audit services, which were approved in advance, was compatible with their independence.

Beneficial Ownership

The following table shows, as of April 14, 2014, the number of shares of our common stock beneficially owned by each director, director nominee and executive officer named in the Summary Compensation Table and all directors and executive officers as a group.

| | | | |

Name | | Number of

Shares(1) | |

Zein Abdalla | | | 11,508 | |

José B. Alvarez | | | 35,308 | |

Alan M. Bennett | | | 38,608 | |

Bernard Cammarata(2) | | | 2,912,474 | |

David T. Ching | | | 38,366 | |

Scott Goldenberg | | | 85,605 | |

Ernie Herrman | | | 719,528 | |

Michael F. Hines | | | 46,819 | |

Amy B. Lane | | | 54,894 | |

Dawn Lepore | | | 3,051 | |

Michael MacMillan | | | 70,000 | |

Carol Meyrowitz | | | 931,234 | |

John F. O’Brien | | | 107,020 | |

Richard Sherr | | | 115,000 | |

Willow B. Shire | | | 91,471 | |

All Directors and Executive Officers as a Group (17 Persons)(3) | | | 5,622,172 | |

14

The total number of shares beneficially owned by each individual and by the group above constitutes, in each case, less than 1% of the outstanding shares. Reflects sole voting and investment power except as indicated in footnotes below.

Include vested deferred shares (and estimated deferred shares for accumulated dividends) held by the following directors: Mr. Abdalla 3,648; Mr. Alvarez 33,190; Mr. Bennett 33,190; Mr. Ching 22,216; Mr. Hines 35,401; Ms. Lane 31,600; Ms. Lepore 1,418; Mr. O’Brien 49,312; Ms. Shire 49,489; and all directors and executive officers as a group 259,464. Shares include 1,418 estimated deferred shares (and estimated deferred shares for accumulated dividends) that vest within 60 days of April 14, 2014 held by each of Mr. Abdalla, Mr. Alvarez, Mr. Bennett, Mr. Ching, Mr. Hines, Ms. Lane, Ms. Lepore, Mr. O’Brien and Ms. Shire and 12,762 held by all directors and executive officers as a group.

Include shares of common stock that the following persons had the right to acquire on April 14, 2014 or within 60 days thereafter through the exercise of options: Mr. Goldenberg 5,167; Mr. Herrman 194,528; Ms. Lane 8,500; Ms. Meyrowitz 273,493; Ms. Shire 24,000; and all directors and executive officers as a group 583,769.

Include performance-based restricted shares that were subject to forfeiture restrictions as of April 14, 2014: Mr. Goldenberg 71,000; Mr. Herrman 525,000; Mr. MacMillan 70,000; Ms. Meyrowitz 240,000; Mr. Sherr 115,000; and all directors and executive officers as a group 1,204,000. Shares listed do not include unvested performance-based deferred stock awards not scheduled to vest within 60 days of April 14, 2014.

| (2) | Includes 166,694 shares owned by a charitable foundation of which Mr. Cammarata is a trustee and 328,445 shares held in family trusts of which Mr. Cammarata is a trustee. Does not include 3,216 shares owned by Mr. Cammarata’s spouse as to which Mr. Cammarata disclaims beneficial ownership. |

| (3) | Includes 16,000 shares owned jointly and over which an executive officer and spouse share voting and dispositive power. |

The following table shows, as of April 14, 2014, each person known by us to be the beneficial owner of 5% or more of our outstanding common stock:

| | | | | | | | |

Name and Address of Beneficial Owner | | Number of

Shares | | | Percentage of

Class

Outstanding | |

FMR LLC(1) | | | 81,776,919 | | | | 11.5 | % |

245 Summer Street | | | | | | | | |

Boston, MA 02210 | | | | | | | | |

| | |

The Vanguard Group(2) | | | 39,545,754 | | | | 5.6 | % |

100 Vanguard Blvd. | | | | | | | | |

Malvern, PA 19355 | | | | | | | | |

| | |

BlackRock, Inc.(3) | | | 36,185,071 | | | | 5.1 | % |

40 East 52nd Street | | | | | | | | |

New York, NY 10022 | | | | | | | | |

| (1) | Amounts above based on ownership of FMR LLC at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 14, 2014, which reflected sole voting power with respect to 5,382,419 of the shares and sole dispositive power with respect to 81,776,919 shares. |

| (2) | Amounts above based on ownership of The Vanguard Group at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 12, 2014, which reflected sole voting power with respect to |

15

| 1,164,656 of the shares, sole dispositive power with respect to 38,458,346 shares and shared dispositive power over 1,087,408 shares. |

| (3) | Amounts above based on ownership of BlackRock, Inc. and certain subsidiaries at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 4, 2014, which reflected sole voting with respect to 29,306,789 shares, shared voting power with respect to 52,167 shares, sole dispositive power with respect to 36,132,904 shares and shared dispositive power with respect to 52,167 of the shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers to file reports of holdings and transactions in our common stock with the SEC and the NYSE. To facilitate compliance, we have undertaken the responsibility to prepare and file these reports on behalf of our officers and directors. Based on our records and other information, all reports were timely filed, other than a delay in filing a Form 4 to report transfers of shares for equivalent value to Mr. Cammarata from three family trusts.

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

TJX is the leading off-price apparel and home fashions retailer in the United States and worldwide. Our management has led very strong performance at TJX through weak and strong economies. We believe our compensation program is critical to motivating our management to achieve our business goals and that a key component to our success is maintaining the ability to engage and develop new and existing talent to execute our business model and long-term, global strategy.

To explain our program and to provide context for our named executive officers’ compensation, we begin with a brief executive summary with highlights of our strong fiscal 2014 performance and an overview of key principles and elements of our compensation program. We then describe our process for making compensation decisions and detail specific elements of our compensation program and the fiscal 2014 compensation of our named executive officers. Our named executive officers for fiscal 2014 were Carol Meyrowitz, Chief Executive Officer; Ernie Herrman, President; Michael MacMillan, Senior Executive Vice President, Group President, TJX Europe; Richard Sherr, Senior Executive Vice President, Group President, Marmaxx; and Scott Goldenberg, Executive Vice President, Chief Financial Officer.

Executive Summary

TJX Performance Highlights

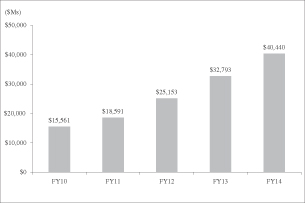

Fiscal 2014 was another successful year for TJX, reflecting our management’s strong execution of our business model.

We reached more than $27 billion in net sales, about 6% more than last year (a 53-week year).

Our total stockholder return was 28% for fiscal 2014, on top of 36% for the year before.

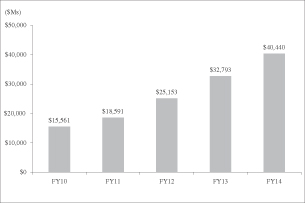

Our market capitalization continued to grow, from $32.8 billion in fiscal 2013 to $40.4 billion at the end of fiscal 2014.

TJX Market Capitalization FY10 - FY14

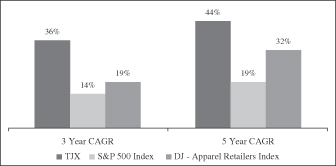

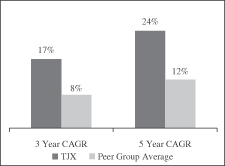

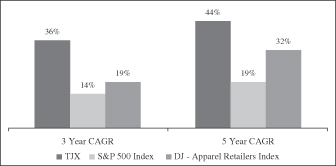

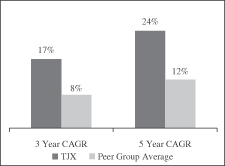

With this year’s performance, our three- and five-year compound annual growth rate for shareholder return exceeded the performance of the general market (S&P 500) and our industry index (Dow Jones U.S. Apparel Retailers Index). In the same periods our adjusted earnings per share surpassed that of our peer group members discussed in this Compensation Discussion and Analysis.

17

| | |

| Total Stockholder Return Growth Rates | | Adjusted EPS Growth Rates* |

| |

| |  |

| * | Adjusted earnings per share (EPS) of TJX and several of the peer group members exclude from diluted EPS from continuing operations computed in accordance with U.S. generally accepted accounting principles (GAAP) the positive and negative effects of items that affect comparability between periods. Peer group average includes only those companies with positive adjusted EPS in the most recent fiscal year or comparable period. Our fiscal 2009 adjusted EPS of $0.96 does not include an estimated $0.04 per share benefit from the 53rd week, $0.01 per share benefit from tax adjustments and $0.02 per share benefit for a reduction in Computer Intrusion related costs from GAAP EPS of $1.04. Our fiscal 2011 adjusted EPS of $1.75 does not include the negative impact of $0.11 per share from operating losses and closing costs of A.J. Wright stores and $0.01 per share benefit for a reduction for Computer Intrusion related costs from GAAP EPS of $1.65. Our fiscal 2012 adjusted EPS of $1.99 excludes the negative impact of $0.06 per share from the A.J. Wright consolidation from GAAP EPS of $1.93. Our fiscal 2013 adjusted EPS of $2.47 excludes an estimated $0.08 per share benefit from the 53rd week from GAAP EPS of $2.55. Our fiscal 2014 adjusted EPS of $2.83 excludes an $0.11 per share tax benefit from GAAP EPS of $2.94. Fiscal 2010 was not adjusted. All share and share-based numbers in this proxy statement reflect the two-for-one stock split effected in February 2012. |

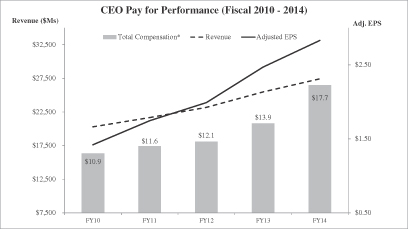

Compensation for fiscal 2014 reflects our strong performance.

Our fiscal 2014 performance exceeded our targets under our annual cash incentive plan (MIP), resulting in above target payouts for our named executive officers (137.65% payout of corporate, 150.36% of TJX Europe and 134.61% of Marmaxx target awards).

Our company-wide performance for the cumulative fiscal 2012-2014 cycle exceeded our target performance under our long-term cash incentive plan (LRPIP), resulting in a 119.57% payout of target awards for our named executive officers.

We satisfied all of the performance-based vesting conditions ending in fiscal 2014 for performance-based restricted stock and deferred stock awards (performance-based stock awards) held by our named executive officers.

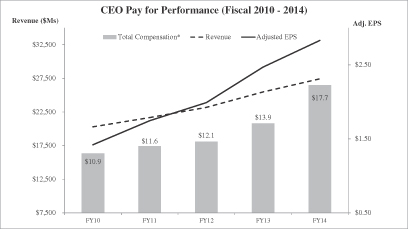

Our CEO’s compensation continued to be correlated with our strong performance:

| * | Total compensation for each fiscal year consists of base salary, annual and long-term cash incentives with performance periods ending in that fiscal year, stock options valued at grant date and performance-based stock awards valued at grant date and allocated to the year of the related performance and service (see “Reporting of Performance-based Stock Awards” below). Reconciliations of adjusted EPS are included in the note to the charts above. |

18

Key Principles

| > | Our program is designed to be balanced, transparent and aligned with our business goals. |

| > | Our program is heavily weighted to at-risk incentive compensation with payout based on performance. |

| > | We seek to maintain shareholder-friendly pay practices and to align the interest of our Associates and shareholders. |

TJX Program Highlights

Our short- and long-term cash incentive compensation is tied directly to achievement of objective, Board-approved performance metrics based on core business goals.

Incentive plan payouts for our named executive officers can be decreased but not increased and are subject to limits on maximum payout.

Our stock awards for named executive officers have performance-based vesting conditions; none are solely time-based.

Our executive officers are subject to and are in compliance with published stock ownership guidelines.

Our named executive officers receive limited perquisites, quantified in the Summary Compensation Table.

We do not provide tax gross-ups on regular compensation or golden parachute tax gross-ups (although we provide tax assistance under our global mobility program).

Severance benefits are payable to our named executive officers following a change of control only upon involuntary termination of employment or termination by the executive for “good reason.”

19

TJX Program Overview

The table below describes the key elements of our compensation program for our named executive officers. All of these elements are intended to help us attract and retain talented individuals, in addition to the more specific objectives summarized below.

| | | | | | |

| Element | | Objectives | | Form |

Salary | | • | | Provide a base level of compensation that reflects individual responsibilities | | Cash |

| | • | | Recognize individual performance and achievement | | |

Annual Cash Incentives (MIP) | | • | | Incentivize performance to reach or exceed our short-term, annual financial objectives, primarily within each business division | | Cash |

| | • | | Reward achievement of financial goals for the current fiscal year, on a divisional or company-wide basis | | |

| | • | consideration• | | Balance our long-term performance goals | | |

Long-Term Cash Incentives (LRPIP) | | • | | Incentivize performance to achieve our long-term financial objectives and foster teamwork across the company | | Cash |

| | • | | Reward company-wide achievement of multi-year financial goals (typically over three fiscal years) | | |

| | • | | Balance our short-term performance goals | | |

| | • | | Provide longer-term retention incentives | | |

Equity Incentives (Options and Performance-based Stock Awards) | | • • | | Reward corporate performance reflected in stock performance Provide longer-term retention incentives | | Equity |

Health, Retirement and Other Benefits | | • | | Provide health and welfare, deferred compensation and retirement benefits, as well as limited perquisites, to further support our competitive position and promote retention | | Other |

| | • | | Provide relocation-related benefits, including tax equalization, to facilitate deployment of our Associates in global service | | Other |

20

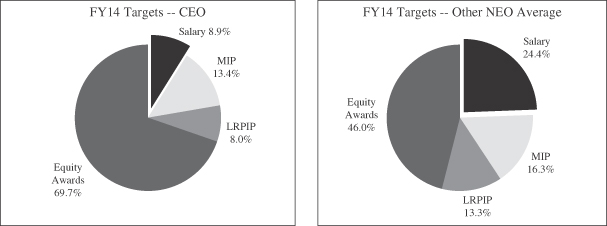

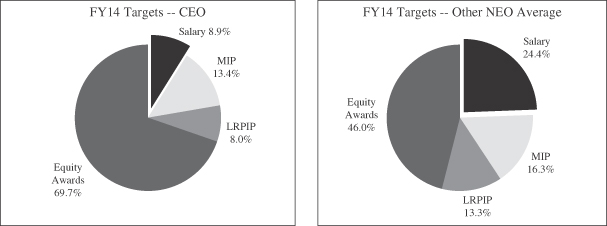

Variable, performance-based compensation constituted a significant portion of target compensation for our named executive officers in fiscal 2014, as shown below.

Fiscal 2014 Executive Target Compensation Elements*

| * | Other NEO average includes all named executive officers other than the CEO. Target compensation consists of annual salary, target cash incentive awards under fiscal 2014 MIP and fiscal 2012-2014 LRPIP (performance periods ending in fiscal 2014), performance-based stock awards with performance periods ending in fiscal 2014 (valued at grant date fair value) and fiscal 2014 option awards (valued at grant date fair value). |

Shareholder Response

Our stockholders have shown strong approval of our executive compensation program. Holders of more than 97% of the shares voting on the proposal approved our advisory “say on pay” proposal at each of our last three annual meetings of stockholders, with more than 98% approving the program last year. The ECC believes that these results reflect our stockholders’ support for our approach to executive compensation, including the focus on incentive components linked to our performance, and has been mindful of this continued stockholder support when acting on compensation matters.

How Compensation Decisions Are Made

The ECC, an independent committee of our Board of Directors, is responsible for compensation design and for approving compensation for our executive officers. The ECC has used the same principle of compensation design for many years: establish a program of total compensation competitive with our peers, heavily weighted toward objective, performance-based incentives. In determining the overall level of executive compensation and establishing the design and mix of its specific elements, the ECC considers various quantitative and qualitative factors, such as company and divisional performance, individual executive’s performance and responsibilities, market data and peer practices, retention and succession planning, contractual obligations, its experience with existing compensation programs, results of our advisory votes on executive compensation, the limitation on income tax deductions imposed by Section 162(m) of the Internal Revenue Code (Section 162(m)), and other matters such as recruitment, promotions, organizational changes, relocations and transitional roles.

21

The ECC acts throughout the year on executive compensation matters and to address any special actions in connection with management changes; employment agreements; retirement plans, deferred compensation and other benefits; and other ECC charter responsibilities. The ECC typically reviews and approves elements of compensation for our named executive officers on the annual schedule below:

| | |

By the beginning of the balancefiscal year | | • Review and approve peer group for new fiscal year |

By the end of potential risksApril | | • Establish award opportunities and rewardsgoals for new MIP and LRPIP performance periods • Grant performance-based stock awards • Approve salary adjustments |

September | | • Grant stock options |

After the fiscal year end | | • Certify performance results for completed performance cycles (for MIP, LRPIP and performance-based stock awards) |

The ECC consults with and reviews data from a compensation consultant to assess the overall competitiveness of our executives’ individual compensation and our compensation program overall and to determine appropriate levels and mix of individual compensation components, as discussed further below under “Compensation Consultant.”

Our executive officers play a limited role in determining executive compensation. Our CEO provides an annual self-assessment to the Corporate Governance Committee and makes recommendations to the ECC regarding compensation of our other named executive officers. These recommendations are based on annual performance reviews completed by the executive to whom each executive directly reports. In addition, the ECC receives a review of the performance of our CEO for the year, including her achievement of performance objectives set by the Corporate Governance Committee (which does not make compensation recommendations). The ECC considers these performance reviews and recommendations, among other factors, in establishing base salaries, cash incentive opportunities and equity grants for our executive officers. More generally, executive officers participate in our strategic planning process and recommend to the Board for its review and approval the annual and multi-year business plans for TJX and its divisions. These Board-approved plans are the basis for the short- and long-term incentive performance targets and the stock award performance criteria, which are approved by the ECC. The ECC regularly meets in executive session and invites executive officers to attend other portions of its meetings.

Compensation Consultant

The ECC has the authority, without Board or management approval, to retain and terminate compensation consultants and advisors and to determine their fees and terms of engagement. The ECC engaged Pearl Meyer & Partners, LLC, or PM&P, to serve as the independent compensation consultant to the ECC for fiscal 2014. PM&P provided industry, peer and market data and advised the ECC on a variety of matters, including the design and competitive positioning of base salary, annual bonus and long-term cash and equity incentives for our named executive officers and other senior management, the establishment and evaluation of a compensation peer group, employment agreement terms, aggregate equity usage and program review, studying high performing company goal setting practices and updates on trends and regulatory developments. The ECC uses this information to determine the overall level and appropriate mix of short-term and long-term incentive opportunities and cash and equity-based opportunities and to determine individual compensation components, including benefits, and perquisites. PM&P did not perform any services for TJX other than work for the ECC and for the Corporate Governance Committee with respect to compensation of directors. PM&P reported directly to the ECC, which determined the scope of PM&P’s engagement and its fees.

22

The ECC regularly reviews the services provided to the Committee by any outside consultants and believes that PM&P is independent in providing executive compensation consulting services. During fiscal 2014, the ECC conducted a specific review of its existing relationship with PM&P, including potential conflicts of interest, and determined that PM&P’s work for the ECC did not raise any conflicts of interest and that PM&P continued to be an independent advisor to the ECC, consistent with the guidance provided under the Dodd-Frank Act, the SEC rules and the NYSE.

Peer Group

As described above, the ECC uses a peer group to provide context for its compensation decision-making for our named executive officers. The ECC regularly assesses this peer group and considers revisions. Before the start of fiscal 2014, advised by PM&P, the ECC reviewed the composition of its peer group to be considered in establishing and evaluating fiscal 2014 compensation for our named executive officers and determined that the following group of 18 large, publicly traded consumer-oriented companies would be appropriate:

| | | | |

Fiscal 2014 Peer Group |

| Amazon.com, Inc. | | Kimberly-Clark Corporation | | Nordstrom, Inc. |

| Bed Bath & Beyond Inc. | | Kohl’s Corporation | | Ross Stores, Inc. |

| Best Buy Co., Inc. | | Limited Brands, Inc. (L Brands, Inc.) | | Staples, Inc. |

| The Gap, Inc. | | Lowe’s Companies, Inc. | | Starbucks Corporation |

| Home Depot, Inc. | | Macy’s, Inc. | | Target Corporation |

| J. C. Penney Company, Inc. | | Nike, Inc. | | YUM! Brands, Inc. |

The ECC determined that the above group was an appropriate peer group for TJX for fiscal 2014 based on criteria that included the following:

revenues ranging from approximately one-third to three times our annual revenue (generally between approximately $8 billion and $70 billion at the time of the analysis);

market capitalization ranging from approximately one-fourth to four times our market capitalization (generally between approximately $8 billion and $130 billion at the time of the analysis); and

comparability of business model, including considerations of financial performance and levels of operational complexity including geographic span, global operations, brand and/or product line diversity, business segments and other strategic and operational factors that contribute to business complexity.

The ECC considered all of these criteria and constructed the fiscal 2014 peer group to reflect a level of business complexity more similar to TJX’s (which resulted in removing Costco and adding Home Depot and Starbucks as compared to the fiscal 2013 peer group).

Although the ECC uses peer group data to provide context for its own determinations, it does not target compensation or any element of compensation for our named executive officers by reference to any specified level at the peer group.

Compensation Program Elements

Compensation for our named executive officers includes base salary, incentive compensation (both cash and equity) and other benefits, each of which is described further below. Rather than applying a set formula, the ECC evaluates and balances the overall mix of each element of compensation.

23

Base Salary

Each of our named executive officers receives a base salary in cash during the fiscal year that is intended to provide competitive, fixed compensation to attract and retain the executive at a level commensurate with his or her responsibilities, performance, experience and value in the marketplace. Base salaries are typically reviewed on an annual basis and may be reviewed in connection with new employment agreements, new positions, or other significant changes in responsibilities. Base salaries at the end of fiscal 2014 are listed below.

Base Salaries at Fiscal 2014 Year End

| | | | |

Carol Meyrowitz | | $ | 1,475,000 | |

Ernie Herrman | | $ | 1,260,000 | |

Michael MacMillan | | $ | 920,000 | |

Richard Sherr | | $ | 770,000 | |

Scott Goldenberg | | $ | 600,000 | |

The ECC approved base salaries for fiscal 2014 based on various factors, including assessment of individual performance and responsibilities, our fiscal 2013 performance, contractual obligations and overall competitiveness. Ms. Meyrowitz and Mr. Herrman each entered into new employment agreements at the end of fiscal 2013 that included new base salaries effective at the start of fiscal 2014. The ECC approved salary increases for Mr. MacMillan, Mr. Sherr and Mr. Goldenberg during fiscal 2014 as part of our annual individual performance and salary review process. The overall salary earned by each named executive officer during fiscal 2014 is reflected in the Summary Compensation Table.

Cash Incentives

A portion of each named executive officer’s compensation consists of cash incentives granted under our Management Incentive Plan (MIP) and Long Range Performance Incentive Plan (LRPIP), each as amended and restated by the ECC during fiscal 2014. Awards under these plans require achievement, at levels specified by the ECC, of performance goals based on performance measures approved by our stockholders. Performance results for both MIP and LRPIP must be certified by the ECC, which has the authority to reduce but not increase the awards to our named executive officers. All MIP and LRPIP awards are subject to a maximum individual payout limit under plan terms (no more than $5.25 million for fiscal 2014 MIP and no more than $5 million for the fiscal 2012-2014 LRPIP cycle). Our cash incentives granted to our named executive officers during fiscal 2014 were intended to qualify for an exemption from the deduction limitation rules of Section 162(m).

Annual Cash Incentives (MIP). The short-term cash incentive awards made under our MIP are designed to motivate our named executive officers and other key Associates to achieve or exceed a performance target pre-established by the ECC for the fiscal year.

Each individual MIP award has a target award opportunity, expressed as a percentage of base salary, tied to fiscal year goals for one or more of the divisions (divisional goals) or a combination of our four major divisions (corporate goals). The goals and target opportunities for our named executive officers for fiscal 2014 are shown below.

| | | | | | | | | | |

| | | Fiscal 2014 MIP Target

Opportunities and Goals | | | |

Name | | % of Salary | | | $ Target | | | Goals |

Carol Meyrowitz | | | 150 | % | | $ | 2,212,501 | | | Corporate |

Ernie Herrman | | | 90 | % | | $ | 1,134,001 | | | Corporate |

Michael MacMillan | | | 55 | % | | $ | 501,770 | | | 75% TJX Europe; 25% Corporate |

Richard Sherr | | | 55 | % | | $ | 419,270 | | | 75% Marmaxx; 25% Corporate |

Scott Goldenberg | | | 50 | % | | $ | 296,155 | | | Corporate |

24

For each fiscal year, the ECC also pre-establishes the divisional and corporate performance targets, amounts payable at different levels of performance, specified rates for converting foreign income and automatic adjustments to reflect certain contingent (but objectively determinable) events that may affect performance. For fiscal 2014, the MIP performance targets were set at specified levels of pre-tax income for each division (or, for corporate awards, a specified level of consolidated pre-tax income for the Marmaxx, HomeGoods, TJX Europe and TJX Canada divisions), excluding in each case capitalized inventory costs, interest income and expense, and U.S. ecommerce. In setting these levels, the ECC believed that the targets were challenging but reasonably achievable. For fiscal 2014, the ECC also established a maximum payout percentage of 200%. The fiscal 2014 MIP performance levels and corresponding payout percentages are shown below, including the thresholds (the level of performance at or below which no payout would be made) and maximums (the level at or above which the award payout would be the maximum under the award terms):

Fiscal 2014 MIP Performance Goals (in 000s)

| | | | | | | | | | | | | | | | | | | | |

| | | Threshold

(Payout % = 0%) | | | | | | Maximum

(Payout % = 200%) | |

| | | | | | (% of Target) | | | Target

(Payout % = 100%) | | | | | | (% of Target) | |

Corporate | | $ | 2,943,362 | | | | 83.3 | % | | $ | 3,532,034 | | | $ | 3,973,538 | | | | 112.5 | % |

TJX Europe | | £ | 116,164 | | | | 75.0 | % | | £ | 154,885 | | | £ | 185,862 | | | | 120.0 | % |

Marmaxx | | $ | 2,175,319 | | | | 85.7 | % | | $ | 2,537,872 | | | $ | 2,819,858 | | | | 111.1 | % |

After the end of the fiscal year, our actual performance is measured against the pre-established performance targets and MIP performance results are certified by the ECC. Participants are eligible to receive their target award if their MIP performance target is met. The payout formulas pre-established by the ECC determine payout percentages for performance above or below target. Our fiscal 2014 MIP performance results were as follows:

Fiscal 2014 MIP Performance Results (in 000s)

| | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | | | |

| | | | | | (% of Target) | | | Variance from

Target ($) | | | Payout % | |

Corporate | | $ | 3,698,243 | | | | 104.71 | % | | $ | 166,209 | | | | 137.65 | % |

TJX Europe | | £ | 170,485 | | | | 110.07 | % | | £ | 15,600 | | | | 150.36 | % |

Marmaxx | | $ | 2,635,481 | | | | 103.85 | % | | $ | 97,609 | | | | 134.61 | % |

The payout of each individual MIP award was determined by applying the applicable payout percentage to the individual’s target opportunity. Based on the performance results for fiscal 2014, the named executive officers with corporate MIP goals earned awards equal to 137.65% of their target award opportunities. Mr. MacMillan earned an award equal to 147.18% of his target award opportunity (150.36% payout for 75% of his award based on TJX Europe plus 137.65% payout for 25% of his award based on corporate). Mr. Sherr earned an award equal to 135.37% of his target award opportunity (134.61% payout for 75% of his award based on Marmaxx plus 137.65% for 25% of his award based on corporate). The actual MIP award earned by each named executive officer for fiscal 2014 is included in the Non-equity Incentive Plan column of the Summary Compensation Table.

Long-Term Cash Incentives (LRPIP). The long-term cash incentive awards made under our LRPIP are based on cumulative divisional performance targets for a multi-year period. The program is designed to motivate our named executive officers and other key Associates to achieve or exceed long-term financial goals, as well as to foster teamwork across the company and promote retention. As LRPIP awards have overlapping multi-year cycles, in each fiscal year we complete a cycle, continue our performance under an ongoing cycle and grant awards under a new cycle.

25

Completion of LRPIP Cycle. LRPIP awards for the fiscal 2012-2014 cycle were granted in fiscal 2012, with individual target opportunities and company-wide performance goals. Our named executive officers’ target award opportunities for this cycle were pre-established by the ECC as follows:

Fiscal 2012-2014 LRPIP Target Opportunities

| | | | |

Carol Meyrowitz | | $ | 1,320,000 | |

Ernie Herrman | | $ | 1,100,000 | |

Michael MacMillan | | $ | 400,000 | |

Richard Sherr | | $ | 300,000 | |

Scott Goldenberg | | $ | 130,000 | |

The ECC pre-established the LRPIP performance goals, including multi-year performance targets and weightings for each division, amounts payable at different levels of performance, specified rates for converting foreign income and automatic adjustments to reflect certain contingent (but objectively determinable) events that may affect performance. For fiscal 2012-2014 cycle, the LRPIP target was based on pre-tax income targets for our divisions for the three-year period, excluding capitalized inventory costs and interest income and expense. The ECC also established divisional weightings, designed to maintain focus at the smaller divisions, and a maximum LRPIP payout percentage of 150%, with each division contributing between 0% and 150% toward the final payout for performance ranging from 33% to 133% of the divisional performance target. In setting these levels, the ECC believed that the targets were challenging but reasonably achievable.

Fiscal 2012-2014 LRPIP Performance Goals

| | | | | | | | |

| | | Cumulative 3-Year

Performance Target

(in 000s) | | | Divisional

Weightings | |

Marmaxx | | $ | 6,125,860 | | | | 68.5 | % |

HomeGoods | | $ | 662,596 | | | | 10.5 | % |

TJX Europe | | £ | 402,623 | | | | 10.5 | % |

TJX Canada | | C$ | 1,246,576 | | | | 10.5 | % |

After the end of fiscal 2014, actual divisional performance for the three-year cycle is measured against each divisional target and the LRPIP performance results are certified by the ECC. Participants are eligible to receive their target award if the LRPIP performance target at each division is met, and the payout formulas pre-established by the ECC determine payout percentages for divisional performance above or below target. The resulting payout percentages are then weighted according to the pre-established divisional weightings (shown above) and added together to determine the overall LRPIP award payout percentage. Our fiscal 2012-2014 LRPIP performance results were as follows:

Fiscal 2012-2014 LRPIP Performance Results

| | | | | | | | | | | | |

Divisions | | Cumulative 3-Year

Actual Performance

(in 000s) | | | Unweighted

Contribution to

Award Payout % | | | Weighted

Contribution to

Award Payout % | |

Marmaxx | | $ | 7,162,023 | | | | 125.37 | % | | | 85.88 | % |

HomeGoods | | $ | 943,545 | | | | 150.00 | % | | | 15.75 | % |

TJX Europe | | £ | 352,480 | | | | 81.33 | % | | | 8.54 | % |

TJX Canada | | C$ | 1,159,216 | | | | 89.49 | % | | | 9.40 | % |

| | | | | | | Total Payout | % | | | 119.57 | % |

26

The payout of each LRPIP award is determined by applying the overall payout percentage to the individual’s target opportunity for that cycle. The actual LRPIP awards earned by the named executive officers for the fiscal 2012- 2014 LRPIP are included in the Non-equity Incentive Compensation column of the Summary Compensation Table.

New LRPIP Cycle. During fiscal 2014, the ECC established the following LRPIP dollar target award opportunities and performance goals for the fiscal 2014-2016 cycle for our named executive officers: Ms. Meyrowitz, $1,475,000; Mr. Herrman, $1,100,000; Mr. MacMillan, $700,000; Mr. Sherr, $500,000; and Mr. Goldenberg, $400,000. The ECC also established LRPIP performance targets for each division for the new cycle, divisional weightings, and a maximum LRPIP payout percentage of 200% for the fiscal 2014-2016 cycle, with each division contributing toward the final payout without a divisional threshold or maximum to better reflect aggregate company results. Assuming that each division performs at the same level against its target performance, the minimum (threshold) level for any payout is 60% of the performance target and the maximum payout level is achieved if performance is at or above 140% of the performance target. Consistent with our past disclosure practice, we plan to provide additional detail about the performance goals for this cycle, which are based on business targets for future periods (fiscal 2015 and fiscal 2016), once the performance cycle is complete.

Equity Incentives

Equity Grant Practices

All of our equity awards are made under our shareholder-approved Stock Incentive Plan (SIP).

The exercise price of each stock option grant is the closing stock price on the NYSE on the grant date.

The ECC does not have any programs, plans or practices of timing these equity grants in coordination with the release of material non-public information.

Virtually all of our equity awards are granted at regularly scheduled ECC meetings held at approximately the same times each year, scheduled in advance. In limited circumstances (for example, in connection with new hires or promotions), the ECC has made equity awards at other times during the year.

The SIP prohibits, without stockholder approval:

| ¡ | | any repricing requiring stockholder approval under applicable NYSE rules and |

| ¡ | | any amendment providing for the payment or provision of other consideration upon the termination or cancellation of any underwater stock option or stock appreciation right. |

Equity awards are made under the SIP, generally in the form of stock options and performance-based stock awards. Stock options do not deliver value unless the value of our stock appreciates and then only to the extent of such appreciation, thus linking the interests of our executive officers with those of our stockholders. Performance-based stock awards include vesting conditions requiring achievement of pre-established performance criteria, linked to TJX’s financial performance. Both stock options and performance-based stock awards also have service-based vesting conditions that provide important retention incentives. Our equity incentives granted to our named executive officers during fiscal 2014 were intended to qualify for an exemption from the deduction limitation rules of Section 162(m).

Stock Option Grants. The ECC determined the number of stock options granted to our named executive officers in September 2013 by setting a fixed dollar value for each named executive officer and dividing this value by the stock price on the grant date. The fixed dollar value for named executive officers is a function of internal compensation levels and historical practices and is reviewed by the ECC for overall market competitiveness. As part of the September 2013 option grant, the ECC supplemented the number of options

27

granted to all participants in the stock option program with an additional award equal to 10% of their basic option award under the fixed dollar formula, based on a consideration of the expected overall award value, market conditions and our stock price. All option awards were granted with an exercise price equal to the closing stock price on the NYSE on the date of grant.

Performance Results for Stock Awards. Each named executive officer held performance-based stock awards with performance-based vesting criteria that were satisfied based on fiscal 2014 MIP performance or fiscal 2012-2014 LRPIP performance, as follows:

MIP-based awards held by Ms. Meyrowitz and Mr. Herrman contained performance-based vesting conditions that were satisfied upon ECC certification of achievement of a fiscal 2014 payout of 137.65% of the corporate MIP target awards (as described under “Annual Cash Incentives” above). The performance condition for full vesting was achievement of a payout of not less than 67% of the corporate MIP target payout, which required us to achieve 94.5% of the targeted performance reflected in the fiscal 2014 plan. The service-based vesting conditions for Ms. Meyrowitz’s award were also satisfied at the end of fiscal 2014, but Mr. Herrman’s award remained subject to service-based vesting conditions after fiscal 2014.

LRPIP-based awards held by our named executive officers contained performance-based vesting conditions that were satisfied upon ECC certification of achievement of a payout of 119.57% of the fiscal 2012-2014 LRPIP target awards (as described under “Completion of LRPIP Cycle” above). The performance condition for full vesting of these awards was achievement of a payout of not less than 67% of the fiscal 2012-2014 LRPIP target payout, which, reflecting the weighting of the divisions and assuming that each division performed at the same level against its target performance, required us to achieve 78% of the targeted cumulative performance reflected in that plan. These awards remained subject to service-based vesting conditions after fiscal 2014.

Grants of Performance-Based Stock Awards. The ECC awarded new performance-based stock awards in fiscal 2014 to our named executive officers based on factors including the executive’s responsibilities, the potential value of each grant and the overall competitiveness and mix of executive compensation, and the ECC also established performance goals applicable to a stock award for our CEO previously approved by the ECC in connection with the CEO employment agreement entered into at the end of fiscal 2013. These awards are reflected in the compensation tables below. Full vesting of these awards is subject to satisfaction of performance-based conditions requiring achievement of a payout of not less than 67% of the target corporate MIP or LRPIP payout for the performance period, which will require us to achieve 96% of targeted performance under MIP (for fiscal 2015 MIP based awards) or 87% of targeted cumulative performance under LRPIP (for fiscal 2014-2016 LRPIP-based awards), taking into account divisional weightings and assuming that each division performs at the same level against its target performance. Performance resulting in a payout below this target level reduces the number of shares that would otherwise vest, pro rata, with no shares vesting if no payout is achieved. Vesting of these awards is also subject to satisfaction of service requirements specified in the awards. The ECC believes that, in addition to linking individual compensation to our target performance, these awards perform an important retention function.

Reporting of Performance-Based Stock Awards

Our performance-based stock awards include vesting conditions requiring satisfaction of performance and service requirements pre-established by the ECC. Under SEC rules, these awards are reported in the proxy statement in the year of grant, as determined for accounting purposes under ASC Topic 718. As a result, the equity compensation of our named executive officers shown in the Summary Compensation Table and in the Grant of Plan-Based Awards Table as granted for a particular year sometimes reflects awards intended by the ECC to compensate the executives for service and performance in other years. See footnote 3 to the Outstanding Equity Awards table for further detail on the vesting terms for stock awards held by our named executive officers.

28

Other Compensation Components

Retirement Benefits. All of our named executive officers are eligible to participate in our 401(k) plan and also participate in a broad-based pension plan for U.S. Associates under which benefits are accrued based on compensation and service. We also maintain a Supplemental Executive Retirement Plan (SERP). Ms. Meyrowitz is a vested participant in our primary SERP benefit program, a nonqualified pension benefit based on final average earnings. We have not offered primary SERP benefits to new participants for many years. Mr. Herrman, Mr. MacMillan, Mr. Sherr and Mr. Goldenberg participate in our alternative SERP benefit program, which is intended to restore pension benefits that would otherwise not be available due to Internal Revenue Code restrictions. These programs are discussed below under “Pension Benefits.”

Deferred Compensation. Our named executive officers can defer compensation under our Executive Savings Plan (ESP), an elective deferred compensation plan, intended to help us compete for and retain talent by providing participants with additional opportunities for personal financial planning and by rewarding and encouraging retention. Participants in the ESP, other than those eligible for our primary SERP benefit, receive an employer match based in part on our performance under MIP. Mr. Herrman, Mr. MacMillan, Mr. Sherr and Mr. Goldenberg received this match for fiscal 2014. Amounts deferred under the ESP are notionally invested in mutual funds or other market investments selected by the participant. Ms. Meyrowitz has amounts previously deferred under our General Deferred Compensation Plan (GDCP), now closed to new deferrals, which earn notional interest at an annually adjusted rate based on U.S. Treasury securities. Mr. MacMillan also has amounts previously saved under our Canadian Executive Savings Plan (CESP). Our deferred compensation plans for named executive officers are discussed with the compensation tables below under “Nonqualified Deferred Compensation Plans.”

Relocation and Expatriate-Related Expenses. As part of our global mobility program, our policies provide that executive officers and other eligible Associates who relocate at our request are eligible for certain relocation and expatriate benefits to facilitate the transition and international assignment, including moving expenses, allowances for housing and goods and services, and tax assistance. These policies are intended to recognize and compensate Associates for higher costs associated with living and working outside the Associates’ home countries, with the goal that Associates are not financially advantaged or disadvantaged as a result of their international assignment and related taxes. During fiscal 2014, Mr. MacMillan continued his leadership of our European division as Senior Executive Vice President, Group President, TJX Europe, after relocating from the U.S. to the U.K. in fiscal 2013, and was eligible for expatriate benefits under this program. These expenses are detailed in footnote 5 to the Summary Compensation Table.

Perquisites. We provide limited perquisites and other personal benefits to our named executive officers. These benefits, which are included below as All Other Compensation and detailed in footnote 5 to the Summary Compensation Table, consist generally of automobile allowances, financial and tax planning services and payment of insurance premiums. None of these perquisites is grossed up for taxes.

Related Policies and Considerations

Employment Agreements. The ECC has reviewed and approved, after consultation with its independent compensation consultant, individual employment agreements for our named executive officers that set their terms of employment, including compensation, benefits and termination and change of control provisions discussed below under “Severance and Change of Control Provisions.” We believe that these employment agreements help retain our executives and support our succession planning process.

In February 2013, we entered into new employment agreements with Ms. Meyrowitz, Chief Executive Officer, and Mr. Herrman, President. The agreements became effective at the beginning of fiscal 2014 and, unless terminated earlier in accordance with their terms, will continue until January 31, 2015 for Ms. Meyrowitz and until January 30, 2016 for Mr. Herrman. In January 2014, we entered into a new employment agreement with

29

Mr. MacMillan, Senior Executive Vice President, Group President TJX Europe, which became effective at the beginning of fiscal 2015 and, unless terminated earlier in accordance with its terms, continues until January 28, 2017.

The agreements with our named executive officers establish a minimum level of base salary and provide for participation in SIP, MIP and LRPIP, at levels commensurate with the executive’s position and responsibilities and subject to terms established by the ECC, and also entitle the executives to participate in TJX’s fringe benefit and deferred compensation plans. Ms. Meyrowitz’s agreement also provides for minimum MIP and LRPIP target award levels during the term of the agreement as well as limited perquisites and specified interest rate assumptions for determining her SERP benefit. Mr. MacMillan’s agreement includes expatriate-related benefits and other provisions related to his assignment with TJX Europe.

Stock Ownership Guidelines.

We have stock ownership guidelines that apply to all of our executive officers:

| • | | Our Chief Executive Officer is expected to our compensation programs and its role in implementation of our corporate strategy.attain stock ownership with a fair market value equal to at least five times annual base compensation. | |

Our President, Chief Financial Officer and each Senior Executive Vice President are expected to attain stock ownership with a fair market value of at least three times annual base compensation.

At age 62, the ownership guidelines are reduced by fifty percent. These guidelines are designed to align our executives’ interests with those of our stockholders and to encourage a long-term focus. Our policies also prohibit our executive officers from engaging in hedging transactions with respect to TJX stock. Each of our executive officers is in compliance with our stock ownership guidelines and policies.

Severance and Change of Control Provisions. We provide severance terms to our executive officers, including in connection with a change of control, in our employment agreements and plans. In connection with these terms, each named executive officer has agreed to post-employment non-competition, non-solicitation and other covenants intended to protect our business. We believe that severance and change of control protections assist in attracting and retaining high quality executives and in keeping them focused on their responsibilities during any period in which a change of control may be contemplated or pending and that, more generally, it is important to define the relative obligations of TJX and our named executive officers, including obtaining protection against competition and solicitation. We seek to achieve these objectives in a manner consistent with our shareholder-friendly pay practices, taking into account contractual obligations and current market practice, among other considerations. These provisions are described under “Potential Payments upon Termination or Change of Control.”

Tax and Accounting Considerations. We generally structure incentive compensation arrangements with a view towards qualifying them as performance-based compensation exempt from the deduction limitations under Section 162(m), but we view the availability of a tax deduction as only one relevant consideration. Further, the ECC believes that its primary responsibility is to provide a compensation program that attracts, retains and rewards the executive talent necessary for our success. Consequently, the ECC authorizes compensation in excess of $1 million that is not exempt from the deduction limitations under Section 162(m).

30

Compensation Committee Report

We have reviewed and discussed the Compensation Discussion and Analysis with management. Based on these reviews and discussions, we recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement and in the Annual Report onForm 10-K for the fiscal year ended January 29, 2011.

February 1, 2014.Executive Compensation Committee

David A. Brandon, Alan M. Bennett,Chair

25